If you have finance related degree then be at ease because there are a lot of finance jobs available. But to be able to get the right finance job for yourself, you need to be sure of what type of skills are required and how well you will be paid. And that is why, we at takethiscourse.net have compiled a list of 10 highest paying finance jobs and desired skills. Here, not only will you be able to find out the highest paying finance jobs but also the type of work that you have to do. So let us take a look at this list.

Desired Skills for Finance Jobs

Below are the desired skills for finance jobs.

- Training and education.

- Having interpersonal skills.

- Ability to communicate with others.

- Aptitude for financial reporting is required as well.

- Analytical know-how is a must.

- Problem solving skills will also add value.

- Management experience would help to do a better job.

- Knowledge of IT software is a must.

Thus these and many more skills can help you get the best finance related job.

- Compliance Analyst

- Key Responsibilities

- Average Salary

- Financial Advisor

- Key Responsibilities

- Average Salary

- Insurance Advisor

- Key Responsibilities

- Average Salary

- Financial Analyst

- Key Responsibilities

- Average Salary

- Senior Accountant

- Key Responsibilities

- Average Salary

- Hedge Fund Manager

- Key Responsibilities

- Average Salary

- Financial Software Developer

- Key Responsibilities

- Average Salary

- Private Equity Associate

- Key Responsibilities

- Average Salary

- Chief Financial Officer

- Key Responsibilities

- Average Salary

- Chief Compliance Officer

- Key Responsibilities

- Average Salary

| Job Title | Median Salary |

| Compliance Analyst | $74,396 |

| Financial Advisor | $95,445 |

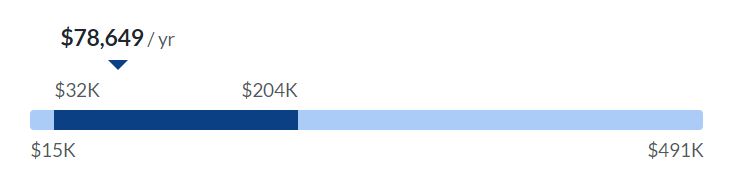

| Insurance Advisor | $78,649 |

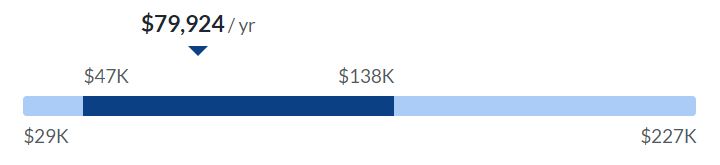

| Financial Analyst | $79,924 |

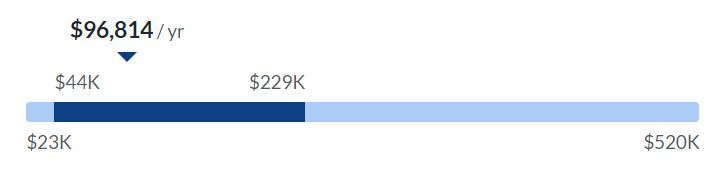

| Senior Accountant | $96,814 |

| Hedge Fund Manager | $135,353 |

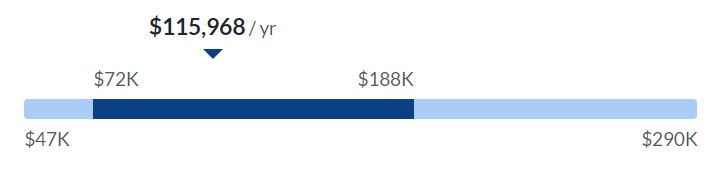

| Financial Software Developer | $115,968 |

| Private Equity Associate | $97,327 |

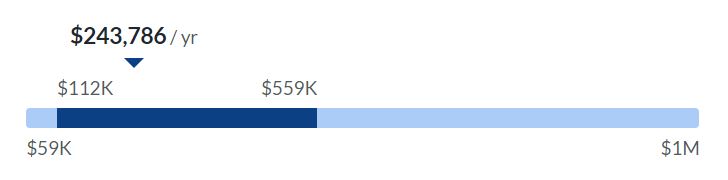

| Chief Financial Officer | $243,786 |

| Chief Compliance Officer | $200,789 |

Introduction to Financial Accounting

Introduction to Financial Accounting

-

-

- Wharton – University of Pennsylvania via Coursera

- 13 hour of effort required

- 234,310+ already enrolled!

- ★★★★★ (6,780 Ratings)

-

Accounting: Principles of Financial Accounting

-

-

- IESE Business School via Coursera

- 12 hour of effort required

- 81,839+ already enrolled!

- ★★★★★ (2,285 Ratings)

-

Highest Paying Finance Jobs

Below are the 10 highest paying finance jobs descriptions, and other details like key responsibilities and average salary etc.

1. Compliance Analyst

A compliance analyst is known to be a financial professional who has to audit a business for compliance against standards set forth by various governing agencies. Since the long-term economic stability and the financial growth totally rely on established standards, the finance industry is thus quite compliance-driven.

Our latest article breaks down the fundamentals of predictive modeling in financial services, shedding light on how data-driven approaches are reshaping decision-making processes.

Key Responsibilities

Below are the key responsibilities of a compliance analyst:

- Analyze and update existing compliance strategies.

- Develop and execute new compliance policies and procedures.

- Oversee the financial infrastructure to ensure all the regulations are met.

Desired Skills

- Data Analytics Skills

- Operations Research

- Financial Planning & Strategy

- Communication & Presentation Skills

Average Salary

- As a compliance analyst, you can expect to make an average salary of $74,396 per year.

2. Financial Advisor

As a financial advisor, you have to help customers identify short and long term financial goals and then lead them directly to products that make sense to them. Check out the the best wealth management courses.

Key Responsibilities

The key responsibilities of a financial advisor are as follows:

- Develop financial strategies by analyzing different strategies.

- Adequate knowledge of all the insurance products.

- Work closely with underwriters and people in risk assessment.

- Implement financial plans or refer clients to professionals.

- Manage and update client portfolios.

- Act as a primary point of contact for your clients.

Desired Skills

- Personal Finance

- Deadline-Oriented

- Data Entry Management

- Reporting Research Results

- Sales and Customer Service

Interested in what classes are available? Browse through our Finance Class Offerings for more information.

Average Salary

- The average salary that you can make as a financial advisor is $95,445 per year.

3. Insurance Advisor

Insurance advisors are the ones who have to represent insurance companies and then sell the insurance products that are offered by all such companies. Their job is to sell insurance policies to the customers and as a compensation for what they do, they earn a commission on each policy that they sell. You might also be interested in things you didn’t know about quantitative finance courses.

Key Responsibilities

Below are the key responsibilities of a insurance advisor:

- They have to help customers in finding the best insurance products for meeting up all the long and short-term insurance needs.

- Then they need to provide guidance on purchasing decisions with regard to insurance for people, home, investments, auto, and more.

Desired Skills

- Prospecting Skills

- Product Knowledge

- Meeting Sales Goals

- Strong Communication Skills

Average Salary

- The average salary that is expected to be made by an insurance advisor is $78,649 per annum.

4. Financial Analyst

A financial analyst has to comb through financial data which then helps business stakeholders in making informed decisions about the company’s finances. They have to work meticulously with the data as all the business decisions of the company are based on this data. You can also checkout Financial Analyst jobs market trends.

Key Responsibilities

Following are the key roles of a financial analyst:

- Establish and evaluate records, statements, and profit plans.

- Identify financial performance trends and financial risk.

- Provide recommendations for improvement based on trends.

- Support buying decisions and needs of the clients. You can also checkout CFA Course and training.

Desired Skills

- Project Management

- Business Finance and Analytics

- Analytical and Problem-Solving Skills

- Interpersonal and Communication Skills

Average Salary

- The average salary that a financial analyst can make is $79,924 a year.

Financial Markets

-

-

- Yale University via Coursera

- 43 hours of effort required

- 392,679+ already enrolled!

- ★★★★★ (5,316 Ratings)

-

5. Senior Accountant

Senior accountants are mostly known to be at the top of an accounting hierarchy and have to perform the day-to-day duties relevant to accounting. You might also be interested in best paying Accounting jobs.

Key Responsibilities

They have to do the following tasks:

- Senior accountants are accountable for sticking to budgets.

- They have to meet accounting goals and oversee corporate expenditures.

Desired Skills

- Deadline-oriented

- Corporate Finance

- Financial Software

- Information Analysis

Average Salary

- The average salary of a senior accountant is $96,814 per year.

Accounting Analytics

-

-

- Wharton – University of Pennsylvania via Coursera

- 10 hour of effort required

- 89,364+ already enrolled!

- ★★★★★ (2,707 Ratings)

-

6. Hedge Fund Manager

The job of a hedge fund manager is similar to those of investment bankers. But the only difference here is that they work with higher risk and reward portfolios for investors who are pooling their capital for investment purpose in hedge funds. It is rarely a career with typical full-time hours.

Key Responsibilities

Here are some of the key responsibilities of a hedge fund manager:

- Hedge fund managers have to monitor markets to protect their investors.

- They have to come to office early and leave late as they have to monitor the market.

Desired Skills

- Portfolio Construction

- Financial Risk Management

- Financial Modeling & Quantitative Skills

- Strong Communication & Interpersonal Skills

Average Salary

- The average salary of a hedge fund manager is $135,353 per year.

7. Financial Software Developer

Financial software developers are the ones who work in the growing Fintech space. They have to create all such programs that meet the needs of the financial institutions and end –users.

Key Responsibilities

Below are the key responsibilities of a financial software developer:

- Design, Develop, and Test the financial software.

- Supervise software programming and documentation development.

- Modify and improve the software used in the finance industry.

- Consult with departments or clients on project status and plan.

- They may have to work for lending organizations as well and other financial organizations. You might also be interested in best Fintech Courses at takethiscourse platform.

Desired Skills

- Programming & Development Skills

- Deep understanding of finance & financial software

- Mathematics & Algorithms inclined

- Data Analytical Skills

Average Salary

- Financial software developers can make an average salary of $115,968 per annum.

Formal Financial Accounting

-

-

- University of Illinois via Coursera

- 10 hour of effort required

- 8,442+ already enrolled!

- ★★★★★ (290 Ratings)

-

8. Private Equity Associate

Private equity associates have to work with private equity firms and analyze and monitor data. These are the professionals who come in contact with investors to gain private equity and then apply to business investments that diversifies the investor’s portfolio. you can also find out credit repair best classes.

Key Responsibilities

Below are the key responsibilities of a private equity associate:

- He is responsible for leading deal processes from beginning to end.

- With that, he has to raise capital from outside investors.

- Next, he has to take responsibility for negotiating banking arrangements.

- Similarly, he has to start building a contact network.

Desired Skills

- Data Analysis

- Financial Modelling

- Negotiation & Communication

- Investment & Accounting Processes

Average Salary

- The average salary of a private equity associate is $97,327 per annum.

9. Chief Financial Officer

The chief financial officer is a person who acts as an officer of a company who has to manage the company’s finances. This includes financial planning, management of financial risks and more.

Key Responsibilities

Below are the duties of a chief financial officer:

- Supervise the planning and preparation of budgets.

- Ensure financial records and receipts are up-to-date.

- Develop and implement financial strategies and plans.

- Effectively manage financial teams.

- Make all the cost-related decisions about technology infrastructure.

Desired Skills

- Quality Management

- Budget Development

- Process Improvement

- Financial & Strategic Planning

Average Salary

- The average salary that a chief financial officer can expect to make is $243,786 per year.

10. Chief Compliance Officer

The chief compliance officer is known to be one of the most important members of the management team. He has to oversee all duties and departments which are relevant to meeting requirements of compliance standards.

Key Responsibilities

As a chief compliance officer, below are the key responsibilities:

- Responsible for overseeing compliance within an organization.

- Develop and analyze company policies.

- Make certain all employees are educated on the current rules and regulations.

- Ensure compliance with laws and take care of regulatory requirements, policies, and different procedures.

Desired Skills

- Legal Compliance

- Statistical Analysis

- Analyzing Information

- Audit & Research Skills

Average Salary

- The average salary of a chief compliance officer is $200,789 per year.

Final Thoughts

As you can see from the above details that finance jobs usually pay off well and if you have the right skills then finding the most suitable job won’t be a difficult task for you. But to be able to do that, you must have all the details required. And that is what this article is for. Therefore sit back, relax and take a look at the 10 highest paying finance jobs and desired skills and get a complete picture of which one is suitable for you. And don’t forget to stay safe, stay home, and never stop learning. You can also check out MSc in Innovation and Entrepreneurship.